Team

Multi-Family Office:Team

Born out of the shared professional experience of its founders working at the same bank, 1875 FINANCE draws on a strong team spirit, resulting in a cohesive approach and a sense of shared responsibility for strategic decisions and for providing client service. This spirit also reflects a century-old commitment to Geneva and Swiss values: excellence, open-mindedness, ethics and respect for fellow team members.

Co-founder, Partner and Head of the Multi-Family Office

Aksel Azrac

Aksel Azrac began his career as a consultant for leading automobile brands. In 1997, he joined Banque Paribas (Suisse) SA in Geneva, where he co-managed the Parvest fund for Switzerland. Later he resumed his consulting activity. In 2001, he joined Banque Ferrier Lullin & Cie, where he was responsible for a portfolio of Swiss and foreign clients and was appointed to the Executive Board in 2002.

He left the bank in 2006 to co-found 1875 FINANCE as a Senior Manager.

Co-founder, Chairman of the Board

Olivier Bizon

Olivier Bizon began his career as a financial advisor for institutional clients with Paribas (Suisse) SA. From 1992 to 1995, he worked at Credit Suisse Private Banking as asset manager for private and business clients. He then moved back to Paribas (Suisse) SA in 1995 to head the private clients division in Switzerland, and served as a member of the Management and then as member of the Private Banking Executive Committee in 2000. In 2001, he moved to Ferrier Lullin & Cie SA as Managing Director. Six month later, he was appointed to the Executive Board, becoming Head of Private Banking for the bank as a whole. In 2005, he was part of the management team that sold three private banks and an asset management business (SBC Wealth Management AG) to Julius Baer.

In 2006, he left the bank to co-found 1875 FINANCE, where he served as Managing Partner and Vice-Chairman of the Board. In 2016, he was appointed Chairman of the Board.

Partner – Head of Legal

Christophe Germain

Christophe Germain obtained his license to practice as a lawyer in 1993 following a traineeship with Maitre Denis Oswald, the former President of the Neuchâtel Bar Association. At the end of 1993, he began working at the fiduciary group Fiduconsult SA as a legal advisor and subsequently was appointed manager of the Neuchâtel branch and head of the legal office for French-speaking Switzerland. He joined UBS SA in April 2000 as a private banking legal advisor for French-speaking Switzerland. In September 2000, he became head of the legal department at Ferrier Lullin & Cie SA, a UBS Group private bank, and was appointed to the Executive Board.

He left the bank at the end of 2006 to join 1875 FINANCE as Head of Legal Office.

Senior Officer – Multi-Family Office

Ernst Grob

Ernst Grob spent his entire career working at Swiss and international banks, building up a wide range of knowledge across all sectors of banking and finance. During his five years as an auditor at Citibank, he travelled extensively. Later he worked in Mexico City for four years as the head of various organisational units. Since then, he has held various management positions in operations and securities departments, and contributed to setting up important strategic projects for the private banks Cantrade Ormond Burrus and then Ferrier Lullin, where he began working in 1987.

Legal Officer – Multi-Family Office

Alexandra Bailly-Maitre

Alexandra Bailly-Maitre began her career in the marketing department of a multi-national company, after which she moved to Dublin where she worked for US financial groups wishing to set up their European hubs in Ireland at that time. Having been hired to relocate their operational departments, she created the French-speaking back offices of CIT Group Europe and Bear Stearns Bank Plc. In 2006, she served as Compliance Officer for a Canadian online payments solutions start-up specialising in online gambling, moving the department from Toronto to Dublin.

After four years at a Geneva fiduciary company, she joined 1875 FINANCE in 2011. With her considerable professional experience, she is a great asset to the Family Office.

Legal and Wealth Officer – Multi-Family Office

Nordine Benadda

Nordine Benadda started his career in 2014 with the Foreign Investors department of PwC France. In 2015, he joined the Gordon S. Blair law firm where he spent three years between Monaco and Geneva dealing with legal and tax matters for UHNWI clients. In 2018, he joined the EY Dubai team where he continued to advise Middle-East family groups to structure and sustain their assets.

Nordine joined the Family Office team at 1875 FINANCE as Legal & Wealth Officer in 2021.

Wealth Planning Officer – Multi-Family Office

Marie-Noëlle Antoine

Marie-Noëlle began her career in Geneva after studying Law in France in Paris II Panthéon-Assas and Lyon 3 Jean Moulin Universities and obtaining a Master’s degree in International Private Law. She started working in trusts with Summit Trust International in early 2015 and joined Reliance Trust Company in September 2016 as Trust Officer in charge of a portfolio of diverse clients and jurisdictions. She obtained the certification of Trust and Estate Practitioner (TEP) in 2018.

She left Reliance at the end of 2020 to join the team of the Family Office of 1875 FINANCE as Wealth Planning Officer.

Senior Officer – Multi-Family Office

Giovanna Albanese Carrieri

Giovanna Albanese Carrieri graduated in Economic and Social Sciences from the University of Geneva, and has since specialised over the years in wealth and succession planning for international private clients.

She obtained her STEP Diploma in International Trust Management whilst working at Lloyds TSB Bank plc. She then joined Pictet & Cie to work in the EPTS department of the Pictet Wealth Management division, after which she served as a Senior Trust Officer at Rhone Trust & Fiduciary Services SA. Following a stint at Royal Bank of Canada SA as an Estate Planning Specialist, she joined the Family Office of 1875 FINANCE SA in November 2016.

Multi-Family Office

Jean-Pierre Limone

Jean-Pierre Limone began his banking career in 1978. After more than 40 years of experience, he passed through various departments, such as Cash, Client Data, Forex, Treasury and Finance.

In 2011, he joined Julius Baer as a financial assistant. In 2015, he was appointed to the position of Account Manager, in direct relation with 1875 FINANCE, more particularly with its Multi Family Office.

He joined 1875 FINANCE in 2022.

Senior Accountant

Hervé Pidoux

Hervé Pidoux received his diploma as a Specialist in Finance and Accounting in 2004, followed by a STEP diploma (Diploma in International Trust Management) in 2010.

He gained professional experience at various fiduciary companies and banks, including Intermandat SA, Amsterdam Trust Company, Rawlinson & Hunter and Royal Bank of Canada. He oversees the accounting and administration of various financial vehicles, including trusts, foundations and Swiss and foreign companies.

He joined 1875 FINANCE in August 2016 as a Senior Accounting Officer for the Family Office.

Investment Advisor – Multi-Family Office

Vittorio Pellegri

Vittorio Pellegri holds a B.Sc. in Management, which he was awarded in February 2017 by Ecole hôtelière de Lausanne (EHL). During his studies, Vittorio completed various marketing and sales internships.

He began his career in finance with an internship at Fundana SA in Geneva. In October 2017, he completed a three-month asset management internship at 1875 FINANCE.

He then joined the Multi-Family Office of 1875 FINANCE in January 2018.

Middle Office Manager, in charge of reporting for the Multi-Family Office

Stefan Meyer

Stefan Meyer began his career in 1994 at UBS Geneva, then joined Pictet & Cie in 1998, where he stayed for 8 years, gaining expertise in project management and business intelligence. He moved to Spain in 2006, mainly in order to work as a BI advisor for key accounts (Cap Gemini, Deutsche Bank, Agbar).

Wishing to return to Switzerland and work in a smaller, more personal setting, he joined 1875 FINANCE in 2014.

Real Estate – Multi-Family Office

Thibaut Bernard

Thibaut Bernard began his career with a construction technician’s certificate in order to learn field techniques. He then trained as a civil engineer to become a construction manager. He managed various large-scale projects (rental housing, PPE, offices, schools, aquatic centers, etc.) as a project manager in several general contractors in France and Switzerland for 10 years, such as FONTANEL GROUPE, GCC GROUPE, GROUPE BATINEG and EDIFEA.

He joined 1875 FINANCE in January 2022 to manage and coordinate the various real estate projects developed by the Family Office.

Real Estate project coordinator– Multi-Family Office

Clélia Millet

Clélia Millet is passionate about real estate and has consolidated her knowledge through studies in law and real estate. In 2019, she will graduate with a Bachelor’s degree in Business Unit Management, specialising in real estate.

After exploring London and New Zealand for a year, she returned to Switzerland in 2020 to begin her career at Cardis Sotheby’s International Realty in Lausanne. She was responsible for inaugurating the prospecting department, a first in Switzerland within this major real estate institution.

A year later, she was promoted to the position of broker at the Morges branch.

On the strength of this rewarding experience, she joined the Family Office property department at 1875 Finance in 2023. Putting her knowledge and goodwill to good use, she is committed to managing and developing her clients’ property portfolios with rigour and enthusiasm.

Assistant – Multi-Family Office

Adriano Auciello

Adriano Auciello received his vocational baccalaureate in 2015 and then started a training course at Haute école de gestion.

In March 2017, in parallel with his studies, he joined the Family Office team at 1875 FINANCE as an assistant.

Assistant – Multi-Family Office

Ganna Lopes

After completing a Bachelor’s degree in European Studies and International Relations in 2013, Ganna gained solid experience by working 3 years at Veron Grauer.

In order to complete her studies, she undertook a training as an assistant accountant and completed an internship at Synergix.

In 2022, she joined 1875 FINANCE as an assistant for the Family Office.

Reporting and consolidation

Multi-Family Office:Reliability and confidentiality

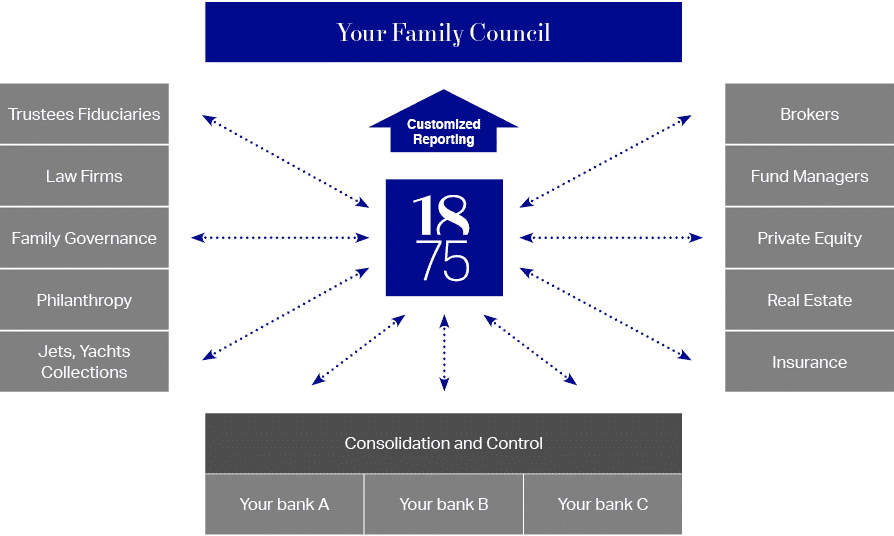

1875 FINANCE is continuously investing in the development of high-performing systems to offer optimal reporting and consolidation solutions for financial and non-financial assets.

Upon request or on a defined schedule, 1875 FINANCE provide customized reports with portfolio details and performance analysis.

Consolidation

For clients with accounts in several banks, we provide a fully customized consolidated overview of their financial assets on a fixed periodicity.

Using state-of-the-art technology, account statement data is delivered to us daily.

For more information

Should you require any additional information, do not hesitate to contact our team of specialists.

Contact

Any questions?

We would be happy to provide you with more detailed information about 1875 FINANCE.

Further links

To find out more about our investment strategy, visit the Asset Management section.

Team

Private clients:Team

Born out of the shared professional experience of its founders working at the same bank, 1875 FINANCE draws on a strong team spirit, resulting in a cohesive approach and a sense of shared responsibility for strategic decisions and for providing client service. This spirit also reflects a century-old commitment to Geneva and Swiss values: excellence, open-mindedness, ethics and respect for fellow team members.

Co-founder, Chairman of the Board

Olivier Bizon

Olivier Bizon began his career as a financial advisor for institutional clients with Paribas (Suisse) SA. From 1992 to 1995, he worked at Credit Suisse Private Banking as asset manager for private and business clients. He then moved back to Paribas (Suisse) SA in 1995 to head the private clients division in Switzerland, and served as a member of the Management and then as member of the Private Banking Executive Committee in 2000. In 2001, he moved to Ferrier Lullin & Cie SA as Managing Director. Six month later, he was appointed to the Executive Board, becoming Head of Private Banking for the bank as a whole. In 2005, he was part of the management team that sold three private banks and an asset management business (SBC Wealth Management AG) to Julius Baer.

In 2006, he left the bank to co-found 1875 FINANCE, where he served as Managing Partner and Vice-Chairman of the Board. In 2016, he was appointed Chairman of the Board.

Co-founder, Partner, CEO (Chief Executive Officer)

Paul Kohler

Paul Kohler began his financial career in 1991 at ELF Trading (formerly Total) in Geneva as assistant to the CFO and controller of crude oil and refined product trading. In 1993, he moved to Paribas (Suisse) SA in Geneva to focus on managing private clients, and was later appointed as a member of Management in 1998.

In 2001, he joined Ferrier Lullin & Cie, a member of the UBS Group, to lead the Swiss management group. In 2005, before the sale of Ferrier Lullin to Julius Baer, he was appointed Director.

In 2006, he left the bank to co-found 1875 FINANCE SA along with Olivier Bizon, Aksel Azrac and the Ormond family member François-Michel Ormond and Jacques-Antoine Ormond.

Paul Kohler currently serves as CEO (Chief Executive Officer) of 1875 FINANCE.

Co-founder, Partner and Head of Asset Management

Jacques-Antoine Ormond

Jacques-Antoine Ormond began his financial career in 1999 at Ferrier Lullin & Cie. Following a move to UBS Warburg and GAM in London, he returned to the Swiss operations of Ferrier Lullin in Geneva in 2001 as a relationship manager. In 2004, he obtained his licence as a Certified International Investment Analyst (CIIA) and was appointed as member of to the Executive Board.

He left the bank in 2006 to co-found 1875 FINANCE. In 2011, he was named a Senior Partner.

Co-founder, Partner and Head of the Multi-Family Office

Aksel Azrac

Aksel Azrac began his career as a consultant for leading automobile brands. In 1997, he joined Banque Paribas (Suisse) SA in Geneva, where he co-managed the Parvest fund for Switzerland. Later he resumed his consulting activity. In 2001, he joined Banque Ferrier Lullin & Cie, where he was responsible for a portfolio of Swiss and foreign clients and was appointed to the Executive Board in 2002.

He left the bank in 2006 to co-found 1875 FINANCE as a Senior Manager.

Managing Director – Private Clients

Andrea Barenghi

Andrea Barenghi began his career in 1984 at De La Rue Giori S.A., where he specialised in banknote creation and the sale of production equipment to various governments. In 1995, he joined Banque du Crédit Agricole Suisse S.A. where he was in charge of bond market-making, forex and as macro-economic analyst on equity markets, interest and exchange rates. In 1999, he joined the newly created Banque Syz and contributed his expertise on client development and the management of dedicated portfolios for wealthy families and Family Offices.

He left Banque Syz in 2015 to join 1875 FINANCE.

Partner – Private Clients

Frédéric Binggeli

Frédéric Binggeli, who has spent over 35 years with three of Switzerland’s most prestigious banking institutions Pictet, Rothschild and Lombard Odier, in investment and wealth management for a sophisticated clientele, has chosen to join 1875 Finance to focus on the three key areas of the company that its clients are looking for, namely:

– Open architecture and the selection of listed and unlisted investments,

– wealth, tax and estate structuring activities,

– real estate consulting.

His widely recognised experience has led him to take on the role of independent advisor to families and to bring new expertise to 1875 Finance, one of the largest players in Europe, for its Multi Family Office and private wealth management activities.

Partner – Private Clients

Michel Alain Bizon

Michel Alain Bizon began his career in 1981 in the international trading department of BNP Paribas (Suisse). In 1984, he moved to the large corporate clients department at the Royal Bank of Canada (Suisse), spending two years in Toronto and Montreal. From 1991 to 1997, he worked at Credit Suisse group both in Geneva and Zurich, as a member of management, dealing with large corporate clients, and subsequently as Division Head for Banking Relations in French-speaking Switzerland. He subsequently returned to Royal Bank of Canada (Suisse) as a member of management for the Private Wealth Management department. In 2003, he moved to the Private Wealth Management department at Mirabaud & Cie SA as a Deputy Director.

He left the bank in 2014 to join 1875 FINANCE.

Relationship Manager – Private Clients

Chantal Constantin-Candolfi

Chantal Constantin Candolfi started her career in 1997 at ING Bank as a junior manager, in 2004 she took responsibility for a portfolio of European clients as a manager.

In 2009, following the takeover of Bank ING by Julius Baer & Cie, she joined the Swiss department and developed a portfolio of Swiss clients and became a member of the Management.

She left Bank Julius Baer & Co. in 2021 to join 1875 Finance.

Senior Private Banker

Fabien de Mallmann

Fabien de Mallmann joined First Chicago in 1974 and worked in commercial banking in the USA, France and West Africa and then as head of credit and trade financing in Switzerland. He led the financing of numerous real estate and international projects, as well as investment banking transactions.

Between 1986 and 1990 he was a managing director for Banque de Financement et d’Investissement in Geneva. In 1990, he became a director with asset management bank Cantrade Ormond Burrus. He left in 1994 to join Pictet & Cie, where he was in charge of a team dedicated to Swiss and European clients. He was also responsible for the Turkish and North African markets and has taken part in several IPOs on those territories.He has also set up a number of private equity funds and has contributed to structuring major family and international assets.

Partner - Head of Legal

Christophe Germain

Christophe Germain obtained his license to practice as a lawyer in 1993 following a traineeship with Maitre Denis Oswald, the former President of the Neuchâtel Bar Association. At the end of 1993, he began working at the fiduciary group Fiduconsult SA as a legal advisor and subsequently was appointed manager of the Neuchâtel branch and head of the legal office for French-speaking Switzerland. He joined UBS SA in April 2000 as a private banking legal advisor for French-speaking Switzerland. In September 2000, he became head of the legal department at Ferrier Lullin & Cie SA, a UBS Group private bank, and was appointed to the Executive Board.

He left the bank at the end of 2006 to join 1875 FINANCE as Head of Legal Office.

Director - Private Clients

Jens Hansen

Jens Hansen started his career in 1985 with Privatbanken A/S, Denmark, and in 1989, he moved to Privatbanken Luxembourg SA as a Client Adviser in the Private Banking department. From 1995 to 1997, he was a Client Adviser in a new started Private Banking department taking care of the HNWI/UHNWI clients of Unibank A/S, Denmark. He was a Senior Client Adviser,from 1997 until 2018, with Unibank Luxembourg SA, which later became Nordea Bank Luxembourg SA with a special focus on the cross border Private Banking business for HNWI and UHNWI clients. As Nordea Bank Luxembourg’s Private Banking activities were taken over by UBS Luxembourg in October 2018, he joined UBS Luxembourg.

In August 2019, he joined 1875 Finance (Luxembourg) SA as Director.

Managing Director - Private Clients

Alain Held

Alain R. Held began his career in technology consulting for Accenture and in management consulting with The Boston Consulting Group (BCG) in Zurich, Switzerland. While at BCG, he advised multi-nationals in financial services across Europe and North America. He contributed largely to the establishment of the Wealth Management practice within the firm. In 2006, as a Senior Project Manager, Alain left BCG to join Deutsche Bank as a Senior Executive and Head of Sales Management PWM. Shortly thereafter, he became the Head of Central and Eastern Europe PWM at Deutsche Bank (Suisse). In 2009, he joined Pictet Bank in Zurich where he headed the CEE / CIS team Zurich and built up an entire team from scratch. He left the bank in 2020 to join 1875 FINANCE.

Alain holds a MSc degree in Computer Engineering from the Swiss Federal Institute of Technology in Zurich and an MBA from the Ross School of Business at Ann Arbor, Michigan, USA.

Executive Director - Private Clients

Mustafa Karadag

Mustafa Karadag began his career in 2004 at Finansbank (Suisse) SA. In 2006, he joined UBS Wealth Management, where he worked in private client management.

In 2013, he left UBS to join 1875 FINANCE, where he serves as an investment manager/advisor for private clients.

Partner - Private Clients

Marc Luthi

Marc Luthi began his career in 1983 at Flemings as an advisor for Asian markets. He then moved to Ernst & Young as an M&A analyst, where he was involved in transatlantic transactions. In 1997, he became head of capital markets at a Geneva bank, and subsequently he co-managed a trust company specialised in wealth planning. In 2004, he was involved in setting up a private bank as Vice-President of the Executive Board and Head of Private Banking.

He joined 1875 FINANCE in 2014.

Executive Director - Private Clients

Burcu Minas Balta

Burcu Minas Balta started her financial career in 2001 as a Relationship Manager at Credit Suisse, with a strong focus on the Turkish Market. She provided bespoke services and advice to Ultra High Net Worth Individuals across all areas of their wealth. Burcu has a holistic approach to service the specific needs of clients, especially in Asset Management and Investment Banking.

After 18 years in Private Banking she joined 1875 FINANCE to continue to cater all wealth management needs of individuals, families and their financial affairs.

Relationship Manager - Private Clients

Eleonora Muratova

Eleonora Muratova started her career in 2008 as Investment Manager at Deutsche Bank in Zurich. She then joined Pictet Zürich team in 2009 where she was taking care of the long-term relationships with the key clients from Eastern Europe region. In 2018 she started working in asset management at Marcuard Heritage AG and in 2020 she joined 1875 FINANCE.

Eleonora holds the master’s degree from Siberian-American School of Management and the second master’s degree from St. Gallen University.

Director - Private Clients

Arly V.L. Petersen

Arly V.L. Petersen hold a BBA in Finance from Copenhagen Business School. He worked for Banks, Real estate finance and Stockbroking companies in Denmark. Since 1988 in Luxembourg working for Nordea as a Relationship Manager for UHNW families through 3 decades. Investment portfolio management competences and strong focus on cross boarder wealth planning with a well-established international network. Implementing wealth solutions for Nordic families living internationally including relocation of families.

He joined 1875 FINANCE in 2019.

Executive Director - Private Clients

Oliver Schmitz

After receiving his bachelor’s degree, followed by a master’s degree in Economy and Finance at the University of Geneva, he began his career at Credit Suisse in 2006. He worked there for 10 years, honing his skills in the Private Banking division and managing and developing a portfolio of Greek and Cypriot HNWI clients.

In 2016, he left Credit Suisse to join 1875 FINANCE.

Partner - Private Clients

Pierre Tardiou

Pierre Tardiou began his banking career at SANPAOLO in 1994 where he worked as a private asset manager in the Financial Markets department until 2000. He joined UBS Monaco to develop the Key Clients segment and to create tailored investment solutions for local and Italian clients. In November 2004, he moved to Geneva to work at Lombard Odier & Cie to develop the UHNWI private client business and to assist families in relation to the sale of businesses and the structuring of real estate transactions.

He left Lombard Odier in 2016 to join 1875 FINANCE.

Director - Private Clients

Jørn Tilsted Christensen

Jørn Tilsted began his career in 1987 with a regional bank in Denmark. Moving to Luxembourg in 1996 joining a Danish banks located in Luxembourg. Becoming a Certified International Investment Analyst ( CIIA ) in 2004.

Managing and developing a portfolio of Danish and Nordic clients for more than 20 Years in various banks, ( Dexia BIL, Nordea and final UBS ) joined the 1875 FINANCE in 2019.

Partner - Private Clients

Pascal Vulliet

Pascal Vulliet began his career in 1987 at Union de Banques Suisses in Geneva. He quickly advanced to a senior management position, with direct involvement in the management of the Private Banking department. Starting in 1990, he focused both on the private clients business as well as the management family assets related to the members of management. In 1992, he was involved in the development of a unit responsible for these specific clients, after which he was appointed as a member of Management.

He served in a management role from 2001 onwards, until he left the bank to join 1875 FINANCE in 2010.

Executive Director - Private Clients

Roman Walker

Roman Walker started his career in the automotive industry at the BMW AG headquarters in Munich before moving to the banking sector at UBS AG in Zurich. During his nine years at UBS, he worked for Active Portfolio Advisory, the UBS representative office in Moscow and as a Relationship Manager and Deputy Head in the Eastern European Department. In 2016, he moved to Pictet in Zurich, where he successfully built an extensive client book. In 2020, he left the bank and transferred to 1875 FINANCE. Roman holds a Bachelor degree in Business Administration from the Schiller International University Heidelberg

Director - Private Clients

Jasmin Woertz

Jasmin Woertz began her career in 2004 at UBS SA, where she completed a traineeship. She subsequently worked as an assistant in the HNWI department. She then joined Julius Baer & Co. Ltd. in 2008, where she worked as an assistant in the Swiss private clients business. In 2012, she became a junior relationship manager for private clients after obtaining her license as a CFP. Three years later she joined Basler Kantonalbank as an asset manager.

In 2016, she left the bank to join 1875 FINANCE.

Relationship Manager - Private Clients

Isabelle Rosenberg

Isabelle Rosenberg started out at UBS SA completing the “Allround” traineeship from 2009 until 2011, subsequently working in the department advising Middle-East clients.

In 2012, she joined the Private Wealth Management department of Mirabaud & Cie SA, which she left in 2014 to join 1875 FINANCE.

She was awarded a federal diploma as a Certified International Wealth Manager (CIWM) in 2017.

Senior Assistant

Sandra Ferrari

Sandra Ferrari began her career in 1995 at Lombard Odier & Cie as an administrative assistant in the Financial Research department, and subsequently as a management assistant for Swiss and Italian clients. She moved to the private bank Ferrier Lullin & Cie in 2000, working in the Swiss Private Clients department, before moving to the Benelux group and finally to the Anglo-UK/Middle East group.

She left the bank in 2006 to follow the partners who co-founded 1875 FINANCE at that time.

Assistant

Michèle Bonvin

Michèle Bonvin began her career in 1987 at SBS working in the Securities department, and subsequently joined UBS following the acquisition of the company. Initially working in the Private Banking back office, she joined the “Special Clients” unit in 2001, in charge of providing support.

She then worked as an assistant to the desk head, with direct involvement in everyday activity, after which she left the major bank in 2010 to join 1875 FINANCE along with Pascal Vulliet.

Assistant

Silvia Bove

Silvia Bove began her career in 2002 with the Swiss cooperative banking group Raiffeisen, where she was responsible for computerising client files.

In 2004, she joined UBS, where she focused on private client management for the African and Israeli markets within the Wealth Management International division.

In 2008, she joined the private bank, Baring Brothers Sturdza SA, as Junior Relationship and Portfolio Manager.

In 2023, she joined 1875 Finance to work with three leading private managers.

Reporting and consolidation

Private clients:Transparent and trustworthy

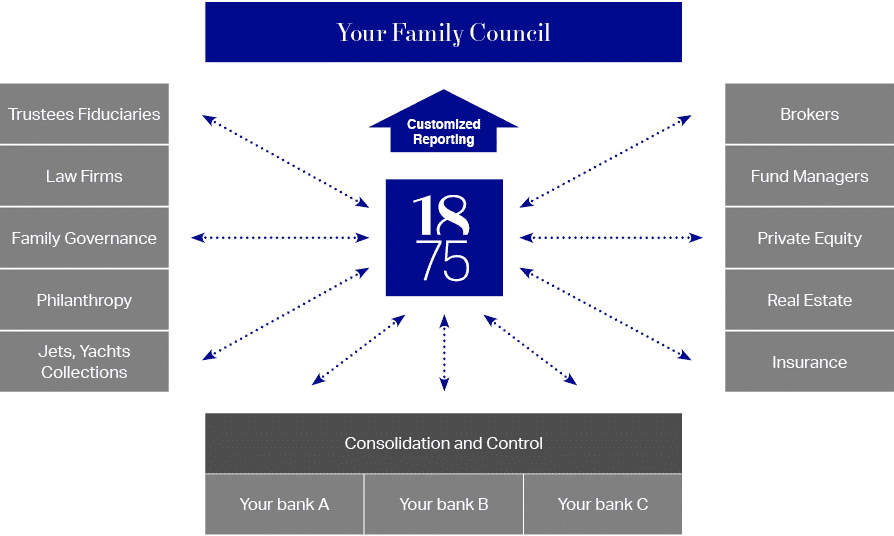

1875 FINANCE is continuously investing in the development of high-performing systems to offer optimal reporting and consolidation solutions for financial and non-financial assets.

Upon request or on a defined schedule, 1875 FINANCE provide customized reports with portfolio details and performance analysis.

Consolidation

For clients with accounts in several banks, we provide a fully customized consolidated overview of their financial assets on a fixed periodicity.

Using state-of-the-art technology, account statement data is delivered to us daily.

For more information

Should you require any additional information, do not hesitate to contact our team of specialists.

Contact

Any questions?

We would be happy to provide you with more detailed information about 1875 FINANCE.

More links

Our new independent model.

Discover the approach and values that set 1875 FINANCE apart.

Philosophy

Private clients:Focus on performance

Performance should not be left to chance. At 1875 FINANCE, expertise, experience and quantitative decision support tools contribute to generate stable risk-adjusted returns.

We endorse the use of a robust best-in-class asset allocation model to neutralize cognitive bias on a top-down basis.

Independence = open architecture = absence of conflicts of interest.

Risk-optimization and monitoring tools calibrate the risk/return of portfolios.

Transparency, liquidity, quality and cost minimization are all important criteria when choosing investment vehicles.

We believe that generating performance primarily depends on capturing market regimes.

Last but not the least, we believe that experience is the key driver of performance.

One of the few FINMA fully licensed asset managers in Switzerland.

Positioned to comply with new regulation and new technology developments.

Through high-grade expertise and trusted networks, we meet our clients high standards by constantly adapting to new developments in Asset Management and new technologies.

Our concept is focused on two essential objectives: securing your wealth and ensuring performance.

For more information

Should you require any additional information, do not hesitate to contact our team of specialists.

Contact

Any questions?

We would be happy to provide you with more detailed information about 1875 FINANCE.

More links

Our new independent model.

Discover the approach and values that set 1875 FINANCE apart.