Asset Management:Private Equity

For more information about private markets and corporate M&A, our team of specialists remain at your disposal for additional information. Contact us.

- Target seeking and qualification (where required)

- Target identification and qualifying (where required)

- Strategic and financial analysis of assets

- Valuation

- Running or coordination of due diligences

- Identification and qualifying of co-investors (where required)

- Structuring of investment vehicle

- Negotiation of deal elements et running of closing

- Deal follow-up over time through to exit while ensuring a presence on the Board of the asset

- Handling of due diligence and risk/return analysis

- Analysis of investment terms (liquidity, hurdle, carry, management fees, horizon)

- Structuring of investment vehicle

- Execution of investment

- Follow-up of assets over holding period

- Preparation of investment documentation (where required)

- Identification and qualifying of investors

- Q&A and investment execution

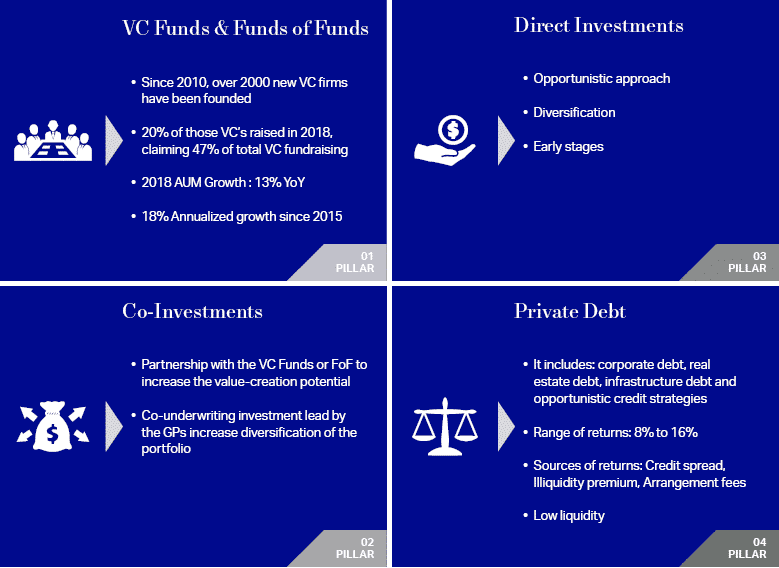

Our offer in Private Equity

For more information

Should you require any additional information, do not hesitate to contact our team of specialists.

Contact

Any questions?

We would be happy to provide you with more detailed information about 1875 FINANCE.

Further links

To find out more about our investment recommendations, visit the Research section.